لماذا ترتفع أسعار صفائح ألياف الكربون خلال أزمات سلسلة التوريد؟

-

جدول المحتويات

“Carbon Fiber Sheet Prices Surge: Supply Chain Crises Unleash Demand and Scarcity.”

مقدمة

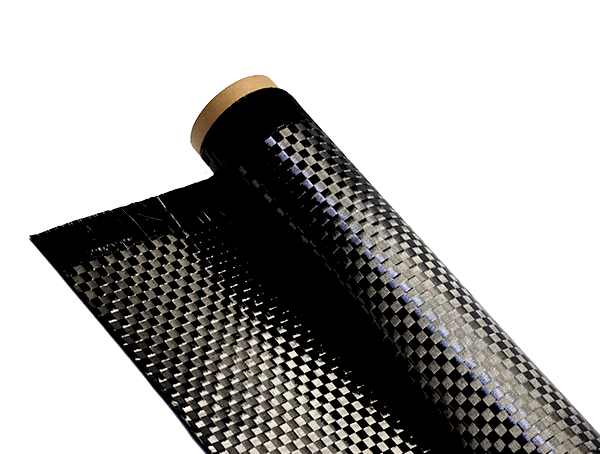

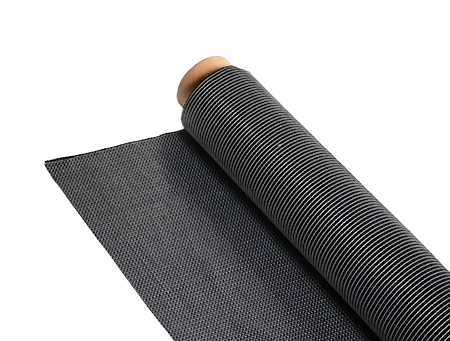

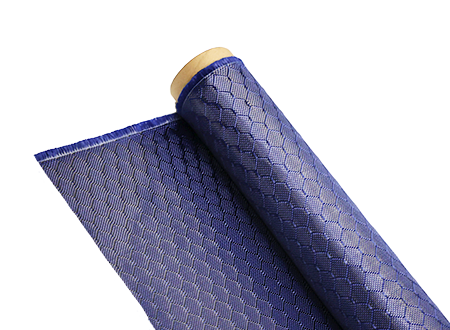

Carbon fiber sheet prices tend to spike during supply chain crises due to several interconnected factors. First, carbon fiber is a specialized material with limited suppliers, making it vulnerable to disruptions in production and distribution. When supply chains are strained, whether due to natural disasters, geopolitical tensions, or global pandemics, the availability of raw materials and finished products diminishes. This scarcity drives up prices as demand often remains steady or even increases in certain industries, such as aerospace and automotive, where carbon fiber is highly valued for its strength-to-weight ratio. Additionally, increased shipping costs and logistical challenges further contribute to price inflation. As a result, the interplay of limited supply, consistent demand, and rising operational costs leads to significant price spikes for carbon fiber sheets during supply chain crises.

Market Demand Fluctuations

The market for carbon fiber sheets has experienced notable fluctuations in pricing, particularly during periods of supply chain crises. Understanding the underlying factors that contribute to these price spikes requires a closer examination of market demand dynamics. As industries increasingly adopt carbon fiber for its lightweight and high-strength properties, the demand for this material has surged, particularly in sectors such as aerospace, automotive, and renewable energy. This heightened interest has created a competitive landscape where supply struggles to keep pace with demand, especially during disruptions.

When a supply chain crisis occurs, whether due to geopolitical tensions, natural disasters, or global pandemics, the effects ripple through the market. Manufacturers often face delays in the procurement of raw materials, which in turn affects their production capabilities. As the availability of carbon fiber sheets diminishes, the existing demand remains robust, leading to a classic case of supply and demand imbalance. In such scenarios, prices inevitably rise as buyers compete for limited resources. This phenomenon is not unique to carbon fiber; it is a fundamental principle of economics that applies across various industries.

Moreover, the nature of carbon fiber production adds another layer of complexity to the pricing structure. The manufacturing process is intricate and requires specialized equipment and expertise. Consequently, the entry barriers for new producers are relatively high, which limits the number of suppliers in the market. When a crisis strikes, existing manufacturers may struggle to ramp up production quickly enough to meet the sudden surge in demand, further exacerbating the supply shortage. As a result, companies may find themselves in bidding wars for available stock, driving prices even higher.

In addition to the immediate effects of supply chain disruptions, long-term shifts in market demand can also influence pricing. For instance, as industries increasingly prioritize sustainability and lightweight materials to enhance fuel efficiency and reduce emissions, the demand for carbon fiber is expected to grow steadily. This trend can lead to speculative buying behavior, where companies stockpile materials in anticipation of future shortages. Such actions can create artificial scarcity in the market, further inflating prices during crises.

Furthermore, the global nature of the carbon fiber market means that local disruptions can have far-reaching implications. For example, if a key supplier in one region faces operational challenges, it can impact manufacturers worldwide who rely on that supplier for their raw materials. This interconnectedness means that even minor disruptions can lead to significant price increases, as companies scramble to secure alternative sources or adjust their production schedules.

In conclusion, the fluctuations in carbon fiber sheet prices during supply chain crises can be attributed to a combination of heightened market demand, production complexities, and the interconnected nature of the global supply chain. As industries continue to embrace carbon fiber for its advantageous properties, understanding these dynamics becomes crucial for stakeholders. By recognizing the factors that drive price volatility, companies can better navigate the challenges posed by supply chain disruptions and make informed decisions regarding procurement and inventory management. Ultimately, the interplay between demand and supply will continue to shape the carbon fiber market, making it essential for industry participants to remain vigilant and adaptable in the face of changing circumstances.

Raw Material Shortages

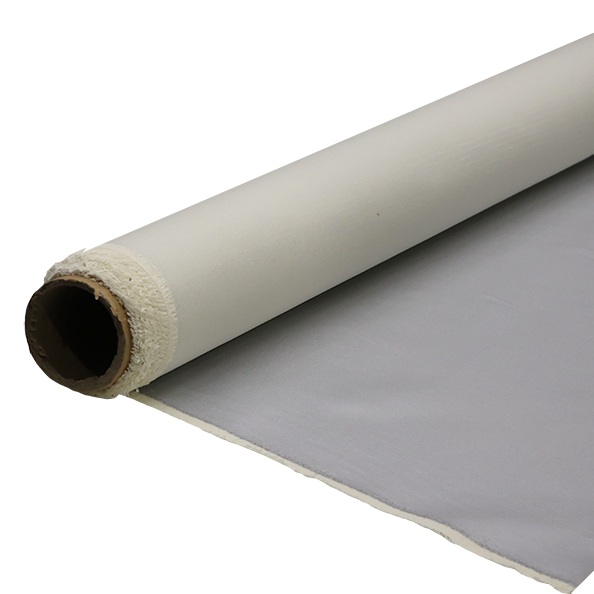

The pricing dynamics of carbon fiber sheets are significantly influenced by various factors, with raw material shortages being a primary driver during supply chain crises. Carbon fiber, known for its exceptional strength-to-weight ratio and versatility, is derived from precursor materials such as polyacrylonitrile (PAN) and petroleum pitch. When disruptions occur in the supply chain, these precursor materials become scarce, leading to a ripple effect that ultimately impacts the cost of carbon fiber sheets.

To understand the implications of raw material shortages, it is essential to recognize the intricate web of the supply chain that supports the production of carbon fiber. The manufacturing process begins with the extraction and processing of raw materials, which are then transformed into fibers through a series of complex chemical and physical processes. Any interruption in the availability of these raw materials can halt production, creating a bottleneck that drives prices upward. For instance, if a natural disaster affects a facility that produces PAN, the immediate consequence is a reduction in the supply of this critical precursor. As demand for carbon fiber remains steady or even increases, manufacturers are left with limited options, leading to heightened competition for the available materials and, consequently, increased prices.

Moreover, the global nature of the carbon fiber supply chain exacerbates the situation during crises. Many manufacturers rely on international suppliers for their raw materials, and geopolitical tensions, trade restrictions, or logistical challenges can further complicate access to these essential inputs. When a country faces sanctions or trade disputes, the flow of raw materials can be severely disrupted, leading to shortages that ripple through the entire supply chain. As manufacturers scramble to secure alternative sources, the costs associated with procurement rise, which is often passed on to consumers in the form of higher prices for carbon fiber sheets.

In addition to geopolitical factors, economic conditions also play a crucial role in shaping the availability of raw materials. During periods of economic downturn, companies may reduce their production capacities or even shut down operations, leading to a decrease in the supply of precursor materials. Conversely, when the economy rebounds, demand for carbon fiber products can surge, creating a mismatch between supply and demand. This imbalance often results in price spikes, as manufacturers are forced to compete for limited resources. The cyclical nature of economic conditions, combined with the inherent volatility of raw material markets, creates an environment where prices can fluctuate dramatically.

Furthermore, the increasing demand for carbon fiber in various industries, including aerospace, automotive, and renewable energy, adds another layer of complexity to the pricing landscape. As more sectors recognize the benefits of carbon fiber, the competition for raw materials intensifies. This heightened demand can lead to speculative buying, where manufacturers stockpile materials in anticipation of future shortages, further driving up prices. Such behavior can create a self-fulfilling prophecy, where the fear of shortages leads to actual shortages, resulting in a vicious cycle of rising costs.

In conclusion, raw material shortages are a critical factor contributing to the price spikes of carbon fiber sheets during supply chain crises. The interplay of production disruptions, geopolitical tensions, economic fluctuations, and increasing demand creates a complex environment that can lead to significant price volatility. Understanding these dynamics is essential for stakeholders in the carbon fiber market, as they navigate the challenges posed by supply chain uncertainties and seek to mitigate the impact of raw material shortages on their operations.

Transportation and Logistics Challenges

The transportation and logistics challenges associated with carbon fiber sheet prices during supply chain crises are multifaceted and deeply interconnected. As industries increasingly rely on carbon fiber for its lightweight and high-strength properties, the demand for this material has surged. However, when supply chain disruptions occur, the resulting impact on transportation and logistics can lead to significant price spikes. Understanding the underlying factors that contribute to these fluctuations is essential for stakeholders across various sectors.

To begin with, the production of carbon fiber is a complex process that requires specialized raw materials, such as polyacrylonitrile (PAN) and pitch. These materials are not only costly but also subject to their own supply chain vulnerabilities. When a crisis arises—be it due to geopolitical tensions, natural disasters, or pandemics—the availability of these raw materials can be severely affected. Consequently, manufacturers may face delays in production, which can create a bottleneck in the supply chain. As demand continues to outpace supply, prices inevitably rise.

Moreover, the transportation of carbon fiber sheets is fraught with challenges that can exacerbate price increases. The logistics of moving these materials from production facilities to end-users often involve multiple stages, including shipping, warehousing, and distribution. Each of these stages is susceptible to disruptions. For instance, port congestion, which has become increasingly common in recent years, can delay shipments and increase transportation costs. When shipping routes are compromised, whether due to labor strikes or increased regulatory scrutiny, the ripple effect can lead to higher prices for carbon fiber sheets.

In addition to transportation delays, the rising costs of logistics play a significant role in the pricing of carbon fiber sheets. Fuel prices, for example, have a direct impact on transportation costs. When fuel prices rise, carriers often pass these costs onto manufacturers and, ultimately, consumers. This situation is further complicated by the fact that carbon fiber is often transported over long distances, making it particularly sensitive to fluctuations in fuel prices. As a result, any increase in logistics costs can lead to a corresponding spike in the price of carbon fiber sheets.

Furthermore, the global nature of the carbon fiber market means that local disruptions can have far-reaching consequences. For instance, if a major supplier in one region faces a crisis, it can lead to shortages in other regions that depend on that supplier. This interconnectedness can create a domino effect, where localized issues escalate into broader supply chain challenges. Consequently, manufacturers may find themselves scrambling to secure alternative sources, often at a premium price, which further drives up costs.

In light of these factors, it becomes clear that the interplay between transportation and logistics challenges significantly influences carbon fiber sheet prices during supply chain crises. As industries continue to navigate these complexities, it is crucial for stakeholders to adopt proactive strategies to mitigate risks. This may involve diversifying suppliers, investing in local production capabilities, or enhancing inventory management practices. By understanding the dynamics of transportation and logistics, businesses can better prepare for potential disruptions and manage costs more effectively. Ultimately, the ability to adapt to these challenges will be key to maintaining competitiveness in a market increasingly defined by its reliance on advanced materials like carbon fiber.

الأسئلة والأجوبة

1. **Question:** What factors contribute to the spike in carbon fiber sheet prices during supply chain crises?

**Answer:** Supply chain crises can lead to shortages of raw materials, increased transportation costs, and disruptions in manufacturing, all of which drive up prices.

2. **Question:** How does demand affect carbon fiber sheet prices during a supply chain crisis?

**Answer:** During a supply chain crisis, demand often remains high while supply diminishes, leading to increased competition for available materials and subsequently higher prices.

3. **Question:** What role do geopolitical issues play in the pricing of carbon fiber sheets during supply chain disruptions?

**Answer:** Geopolitical issues can lead to trade restrictions, tariffs, or sanctions that limit the availability of carbon fiber materials, causing prices to spike due to reduced supply.